How to Become an Amazon Seller in 5 Easy Steps

With the emergence of third-party selling platforms, it’s no longer necessary for sellers to create their own website. In fact, many of these platforms are so effective that sellers have built their entire business around them. The most popular of these is Amazon.

According to data from FactSet, Amazon revealed third-party seller service revenue of $117.7 billion in their fiscal year 2022. Amazon is a highly trusted brand today, so when an entrepreneur operates under their umbrella, they gain added consumer trust.

Are you interested in learning how to become an Amazon seller? The process is actually easier than you might think. You don’t need to be authorized or certified to sell on their platform. Anyone can do it.

Table of contents

This guide will walk you through all the requirements and steps you’ll have to take to find success.

How to Start Selling on Amazon

Below are the steps for getting started on Amazon. Every step is important so don’t rush them. Take your time and do everything properly in order to give yourself the best chance at success.

#1 Find a Product

To begin with, you'll need to select your first product. This is the most interesting and challenging stage. Even if you’re selling handmade items you’ll want to do some product research to ensure you’re selling a winner.

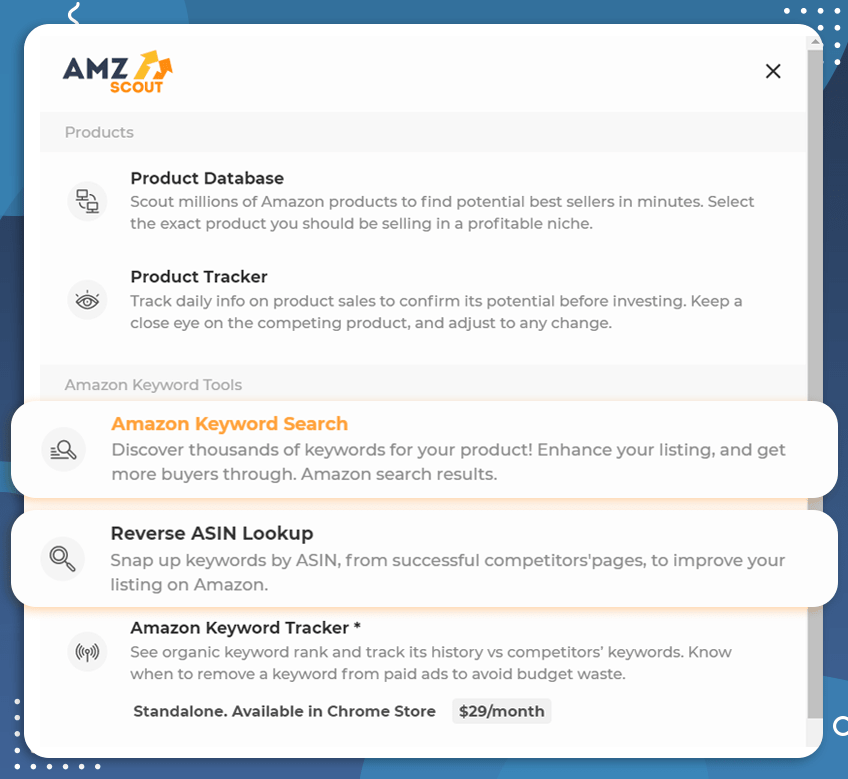

Luckily, AMZScout offers a full range of tools to help you find products that are profitable and present good selling opportunities.

Here’s a quick rundown of how to find profitable products to sell:

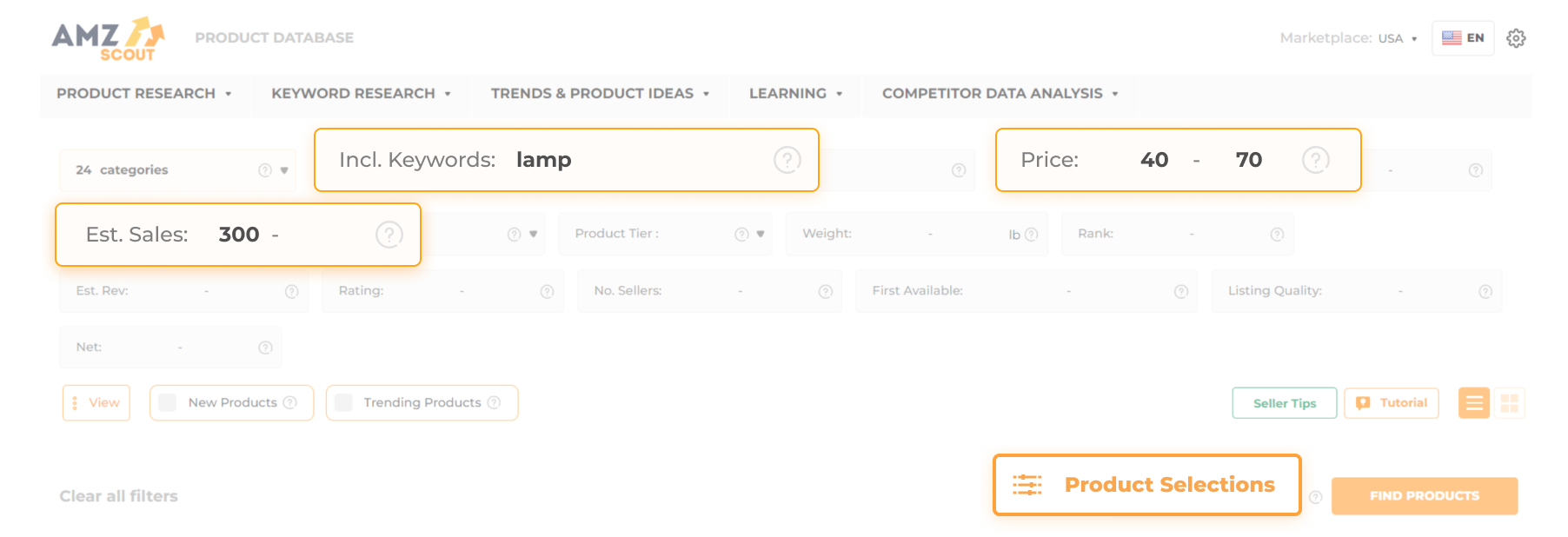

1. Open the AMZScout Product Database.

2. Start your free trial. New users will see a sign-up form for a free trial. Type your information to begin the trial.

3. Define product criteria. Use the search filters to set your criteria. You can filter by price, sales, and other variables. If you aren’t sure what criteria to set, start with one of the ready-made sets from Product Selections or learn more about the options in this article.

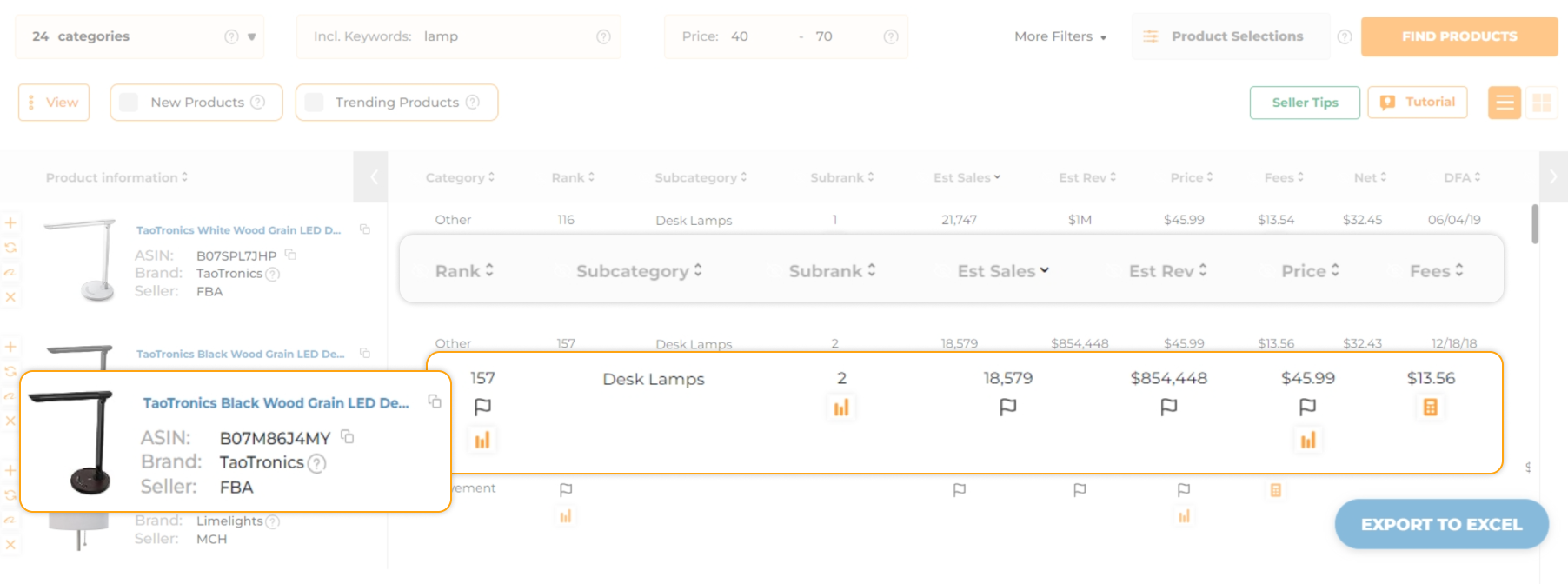

4. Check your results. Select Find Products.

5. Select the interesting ideas to analyze with PRO Extension.

Any product ideas that you find with the Database also need to be checked with the PRO Extension to choose the most profitable niches with low competition.

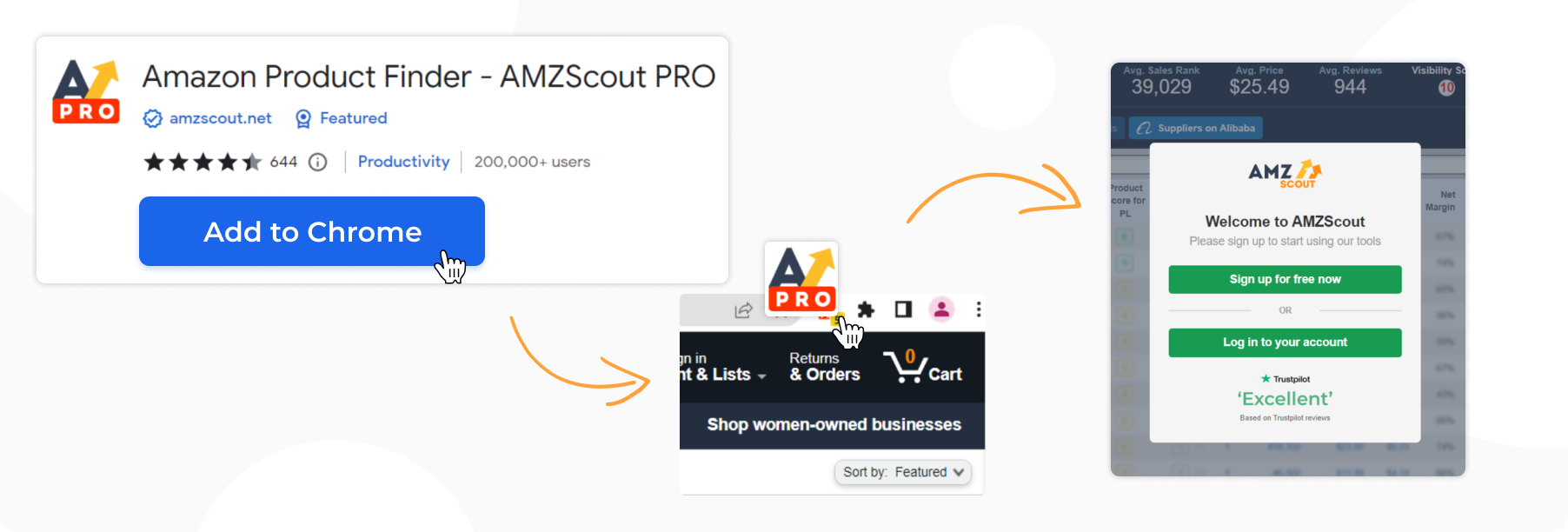

1. Install the AMZScout PRO Extension for Chrome.

2. Open the Extension

Amazon will open automatically when the download is complete.

Start your free trial. If you are a new user, you’ll see a form to sign up for a free trial. Enter your information to get started.

Use Amazon’s search to find a product or niche that you looked at with the AMZScout Product Database.

After the results appear, find the AMZScout symbol in the bottom left corner of your browser and open the PRO Extension.

3. Analyze profitability for products and the niche. Check revenue, net margin, and sales for specific products and look at the niche average at the top of the screen.

4. Determine potential monthly profit.

Click the row for an interesting product to open more tools.

Click Profit Calculator.

Enter your data: product price and cost, additional costs, etc.

Review the estimated monthly profit.

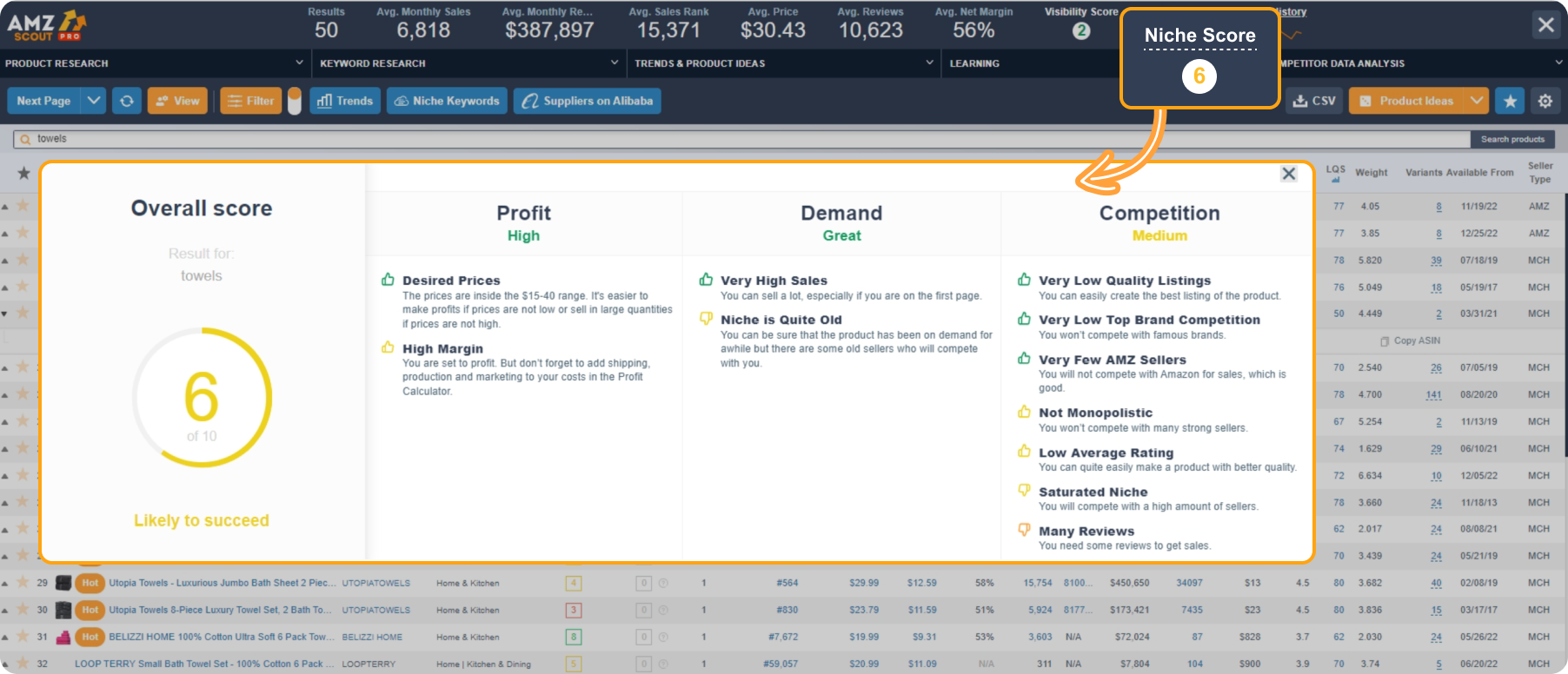

5. Assess niche demand. Select Niche Score for a detailed analysis of the overall demand for the niche.

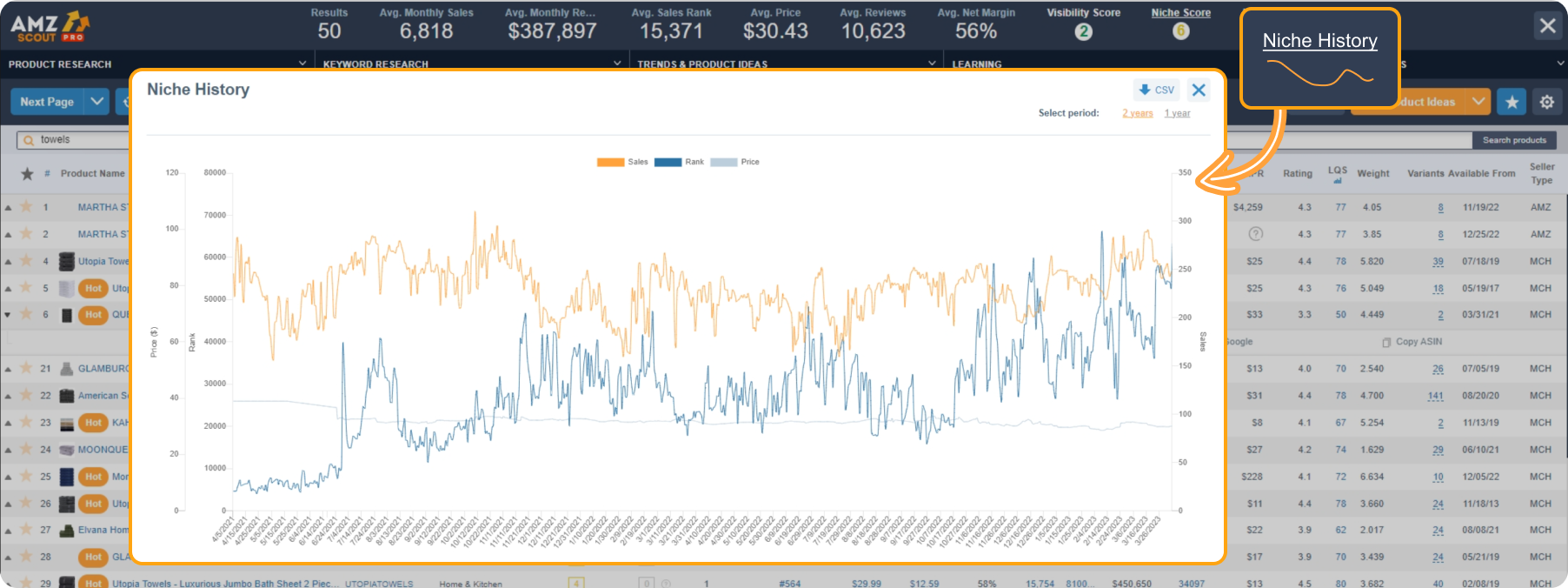

6. Make sure demand is consistent. Check the Niche History to see if demand is high year-round and not seasonal.

Product research is an extremely important step, but if you use the right tools you’ll find it’s actually fairly easy to find profitable products.

Receive a Personalized Product Research Report with Product Ideas

Sellerhook offers specialized services to make your product research more efficient. Their team of researchers, assisted by advanced AI algorithms, will conduct product research according to your criteria. As a result, you’ll receive a detailed Amazon product report with product ideas that meet your specific requirements.

#2 Create an Amazon account

After you’ve decided on a product to sell, you’ll need to create a seller account. To become a seller on Amazon, you need to provide a valid government-issued ID, tax information, a credit card, a phone number, and a bank account.

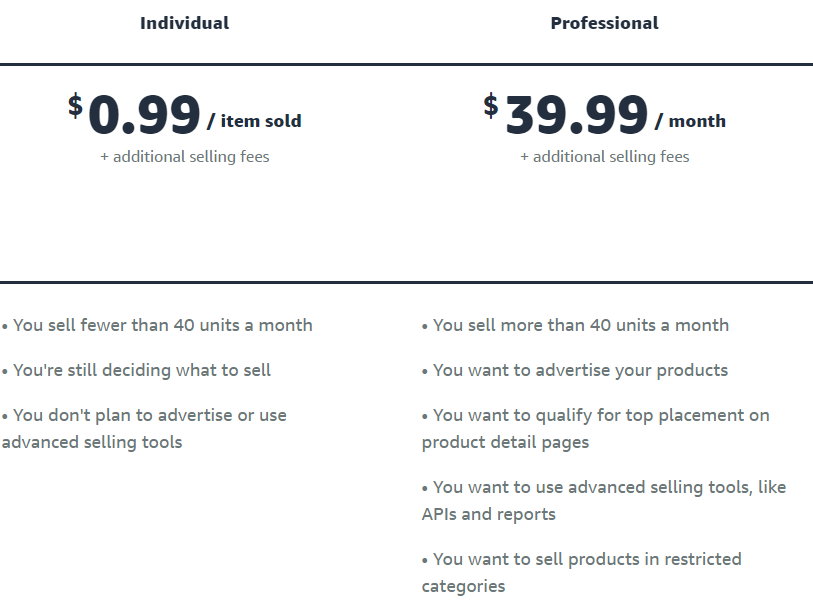

The cost of becoming an Amazon seller varies depending on the seller plan you choose. The Individual plan costs $0.99 per item sold, while the Professional plan costs $39.99 per month, regardless of the number of items sold. Additionally, both plans include referral fees and variable closing fees based on the product category.

#3 Source Your Product

Once you have a product you want to sell you’ll need to find somewhere to source it. Most successful sellers source their products from China using Alibaba or other similar portals.

That being said, there are other options. If you sell in the US market it might be a good idea to look into US manufacturers, as “Made in USA” products are well respected. Buying locally can also help you save on shipping. India has many quality suppliers and manufacturers as well that are worth looking into.

Shop around and find a supplier that can offer you good quality products and a price that works with your budget.

#4 Create Your Listing

Once you have your product you’ll need to create your listing. The quality of your listing will have a huge impact on how high you rank in Amazon searches and how many people will buy your product, so be sure to follow the tips below to create the best listing possible:

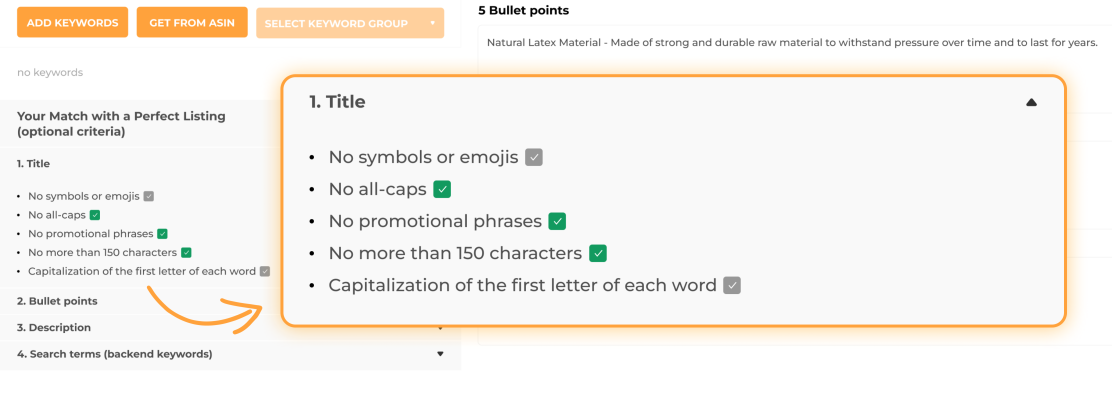

Use the AMZScout Listing Builder: Help your listing rise to the top of search results for related queries. Avoid mistakes when compiling a listing by using the AMZScout AI Listing Builder, which will help you check the accuracy of your listing. Additionally, if you're struggling to come up with the necessary text portions of your listing, you can use the built-in AI tool to generate them for you.

Use High-Quality Images: Use hi-def images that clearly show the product’s features and follow Amazon’s guidelines. Click here for more information on images.

Include Keywords: Including the right keywords throughout your listing is an important part of showing up in Amazon search results. Use the Keyword Explorer and Reverse ASIN Lookup tools to find the best keywords for your product.

Focus on Benefits: Don’t just say what your product does. Explain why people should want it and how it will make their lives easier and/or better.

Monitor Your Listing’s Performance: It's important to monitor your performance and adjust your strategy accordingly. Use the Keyword Tracker by AMZScout to track changes in keyword rankings.

For example: If you sell dog food, a top keyword like "healthy dog food" is highly competitive and also slow to show results. In contrast, "natural dog food for puppies" has lower competition and can deliver faster results. Therefore, focus on high-competition keywords to boost brand visibility, while also targeting keywords that are trending less competitive to seize new market opportunities quickly.

If you’re not sure which keywords to pick for your listing, think about using a professional keyword research service. This can boost your chances of success and make the most of your time and effort. Let’s explore this in the next section.

#5 Market Your Listing with PPC Ads

If you create your listing properly, over time it will begin to show up in customer searches. However, if you want to start getting traffic right away it’s a good idea to run some PPC campaigns. With these ads, you’ll begin appearing in the sponsored sections of searches.

Amazon advertising budgets are flexible, and when managed correctly, they can generate more revenue than you spend. Targeting the right keywords is crucial, but identifying the best ones for PPC targeting can be challenging due to factors like cost, relevance, and more. This is where Sellerhook can assist you.

Sellerhook’s experts research the market thoroughly to provide a list of the best-performing keywords for your product, and enhance your PPC and overall listing effectiveness. You'll gain insights into your competitors' strategies and see keywords used by top-selling products.

Here are the key things you'll get:

A list of the top keywords for your product

Competitor research

Effective tips and strategies for optimizing your listing and PPC campaigns

To see the details, check out a sample report.

This approach will help you run more effective PPC campaigns and manage your budget more efficiently.

Tips to Consider Before You Start Selling

Like any business, if you want to make it as an Amazon seller you need a solid business plan. The planning stage may not be as exciting as the other steps, but it’s just as important so make sure to take the time to do it right.

#1 Decide on a Business Model

Before becoming an Amazon seller you’ll need to decide what type of business you’re going to operate. The two main questions you need to ask yourself are how are you going to acquire your products and how are you going to deliver those products to your customers.

For sourcing products, there are a few different options. You can do retail arbitrage where you buy items from local retail stores that are selling for lower than they are on Amazon and then resell them for a profit. This is good for beginners but it isn’t all that scalable.

If you’re really serious about building a business it’s best to purchase your products from wholesale businesses or manufacturers. If you buy from manufacturers you even have the option of creating your own private label products.

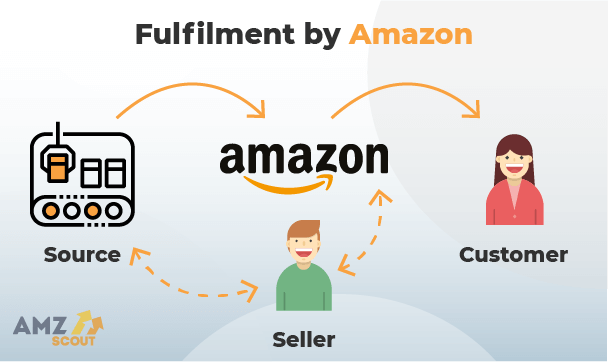

When it comes to fulfilling your orders, there are two ways to do this:

Fulfilled by Merchant: You store your own inventory and ship products to customers yourself.

Fulfilled by Amazon: You ship all your inventory to Amazon to be stored in their warehouses and they fulfill your orders for you.

Do your research and determine which model fits your needs best.

#2 Join an Amazon Community

This is a great way to get some useful tips and tricks. Joining a community not only provides great information, but it also keeps you up to date with what’s happening in the market. Perhaps best of all though, you’ll be able to ask other more experienced sellers questions if you run into any problems.

#3 Set Your Budget

Initially, you’ll have to spend some money on tools and inventory to get your business up and running. Think of it as an investment in your business. And as you grow, you’ll have to continue spending money on inventory and launching new products.

Determine how much money you can afford and set your budget for all the costs (inventory, tools, marketing, etc.) Make sure to stick to your budget to ensure you don’t run into trouble down the road.

#4 Be Realistic

It’s easy to get caught up in all of the unbelievable success stories of new Amazon sellers. Unfortunately, this isn’t realistic for every seller.

Don’t expect huge returns immediately. To become a successful seller requires hard work, at least during the initial stages until your product moves to the top. And even if you have a Best Seller’s tag, it requires work to maintain it.

Your business will face a number of ups and downs so prepare for every scenario. That way you won’t be discouraged if you hit a rough patch. That being said, if you keep working hard and doing things the right way you should be able to grow a profitable business in a matter of months.

Advantages of the Fulfilled by Amazon Program

As we previously discussed, when it comes to selling through Amazon you have two options: Fulfilled by Merchant and Fulfilled by Amazon (FBA).

The main difference between having items fulfilled by Amazon and fulfilling them yourself is that you have to do all the work. This can prevent you from having time to grow your business, leading to lower profits over time.

As an FBA seller, Amazon picks, packs, and ships your items for you, eliminating the concerns mentioned above. This means you don’t have to worry about shipping products to customers or storing your inventory.

Amazon will do everything for you - just ship your product to an Amazon fulfillment center and Amazon will:

Store your inventory

Pick and pack your products

Ship them to your customer

Provide customer service

The FBA program is extremely convenient and allows you to sell from any country. You can run your business from anywhere without having to even touch the goods or deal with warehouses and shipping.

How to Become an Amazon FBA Seller

Using the FBA program to sell your products is surprisingly easy. You can send products to Amazon fulfillment centers by setting up virtual shipment in your Seller Central account.

1. Create a virtual shipment in your Seller Central account. Then you can send products to Amazon fulfillment centers using the FBA program.

2. Prepare your shipment. When preparing your shipment, you can either choose to prepare and label all the products yourself, or use the labeling and prep services provided by Amazon.

In the first case, you’ll prepare your shipment yourself. You’ll also need equipment to print barcodes and other stickers for the products. If that sounds like too much work, you have the option of using a prep center, or you can make arrangements with your supplier to do it for you.

3. Choose a method for shipping your items to an Amazon warehouse. Amazon offers a few options exclusively for FBA sellers. Manufacturers may also offer some options for shipping your items directly to Amazon’s warehouses.

4. Prepare and document the shipping plan effectively. This will enable you to keep track of the products that are being shipped.

5. Get your products ready for sale. Products received by an Amazon fulfillment center are scanned and made available for sale within three business days.

Conclusion

So, that’s how to become a seller on Amazon. The company has a very strong reputation for putting its customers first. By selling on their marketplace you’ll be able to take advantage of that reputation and grow your business much faster.

With some hard work, the right product research tools, an initial investment, and a little luck, you’ll have the recipe for a consistent five or six-figure income.

As you take your first baby steps towards becoming an online entrepreneur, remember that things are constantly changing. Keep learning and absorbing new knowledge. This will allow you to adapt and ensure you build a business that will be super profitable for years to come.