Amazon Seller Insurance: Protect Your E-Commerce Business

Running a business on Amazon’s marketplace can be an exciting venture filled with opportunities for growth and profitability. However, it also comes with its own set of risks and challenges. From product liability claims to unforeseen shipping mishaps, having the right protection in place is crucial.

This is where Amazon seller insurance plays a pivotal role. In this guide, we’ll walk you through the reasons why it’s important for Amazon sellers to have insurance, the types of available coverage, and additional strategies for safeguarding your e-commerce business.

Table of contents

Why Do Amazon Sellers Need Insurance?

Operating as an Amazon seller exposes you to various potential risks that could impact your business’s stability and reputation. Amazon’s requirements mandate that certain sellers carry insurance, especially those who generate $10,000 or more in monthly revenue. But even in cases where it’s not required, having a solid insurance plan still offers several benefits, including:

Liability Protection: If a buyer claims that your product has caused injury or damage, insurance can cover any related legal fees and settlements.

Shipping and Inventory Coverage: This protects your goods from loss or damage during transit or storage at a fulfillment center.

Peace of Mind: With the right policy, you can focus on growing your business without worrying about potential financial setbacks.

Investing in Amazon insurance not only helps you meet the platform’s requirements but also safeguards your business against unexpected challenges, allowing you to operate confidently and sustainably.

Types of Insurance for Amazon Sellers

There are several types of insurance that cater specifically to the needs of e-commerce sellers. Here’s an overview of available options:

General Liability Insurance: This type of policy covers bodily injury, property damage, and personal injury claims. It also tends to be a requirement for sellers with professional accounts.

Product Liability Insurance: This coverage is essential for both private label sellers and resellers, as it protects you in case of claims that arise from defective or harmful products.

Commercial Property Insurance: Safeguard your inventory and equipment from risks such as theft, fire, or natural disasters.

Commercial Auto Insurance: If your business involves the use of a vehicle for shipping or delivery, this policy provides coverage for accidents.

Umbrella Insurance: This option offers additional coverage beyond the limits of other policies, making it especially ideal for high-risk businesses.

Each type of insurance serves a specific purpose, and ensures that your business is prepared for unforeseen events, whether it’s a product defect claim, damaged inventory, or an accident involving a delivery vehicle. By investing in the right policies that are tailored to your business needs, you can focus on growing your e-commerce venture with greater peace of mind.

How to Find Insurance for Your Amazon Business

Finding the best insurance plan for your Amazon business involves a few key steps. Here's how you can streamline the process:

Evaluate your business risks. Assess the unique risks associated with your specific products, operations, and market. Consider factors such as product safety, shipping routes, and customer demographics.

Choose the right type of insurance. Determine which policies align best with your business needs. For example, a private label seller might prioritize product liability insurance, while an LLC might require general liability coverage.

Compare plans and providers. Research reputable insurance providers that specialize in e-commerce. Companies like NEXT Insurance, Hiscox, and Assureful offer tailored plans for Amazon sellers at a competitive cost.

Finding insurance might seem a bit challenging at first, but with the right guidance, it can be a smooth process. Consider consulting with a lawyer to help you choose and obtain the right option ensuring that all legal aspects are covered and your business is fully protected. A professional can also assist you with identifying any specific coverage requirements that are unique to your business model.

Additional Ways to Protect Your Amazon Business

Insurance is a vital part of your risk management strategy, but there are other steps you can take to ensure that your business remains resilient:

1. Thorough Product Research

Selecting the right products to sell is the foundation of any successful e-commerce business. Conducting thorough product research minimizes the risk of investing in low-demand or high-risk items. Use special tools like the AMZScout PRO AI Extension to help you evaluate the profitability of any product. Here’s how:

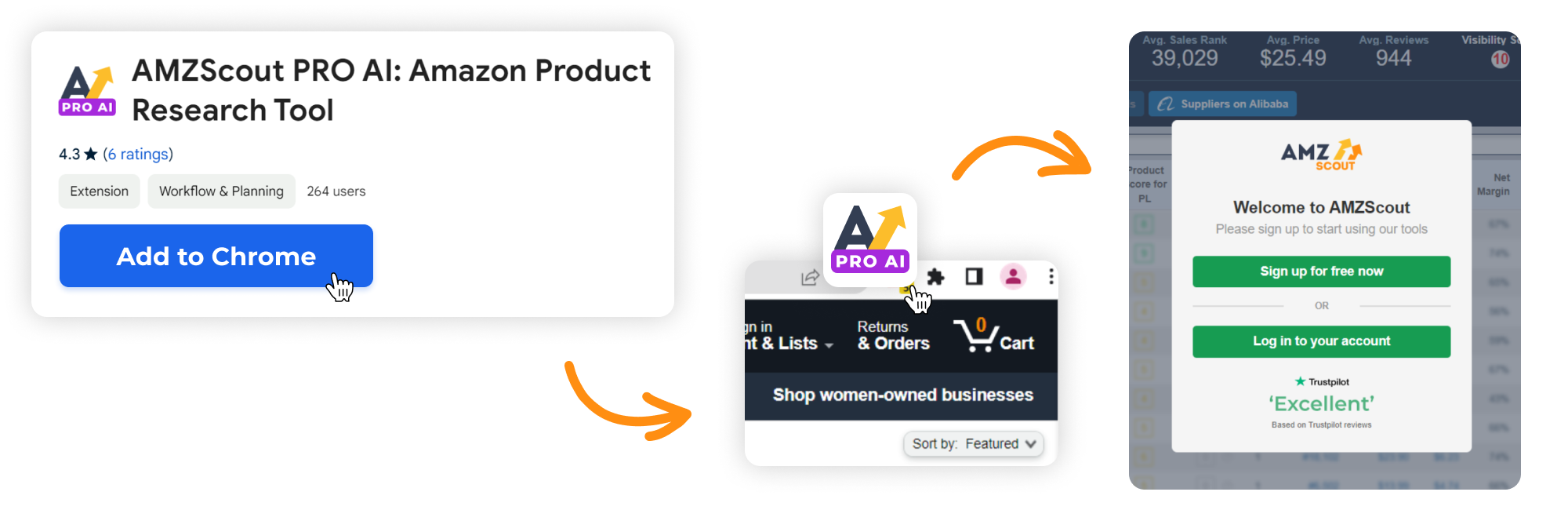

1. Open the product you want to analyze on Amazon and launch the AMZScout PRO AI Extension. You can sign up for a full-transparency free trial without needing to enter any credit card information.

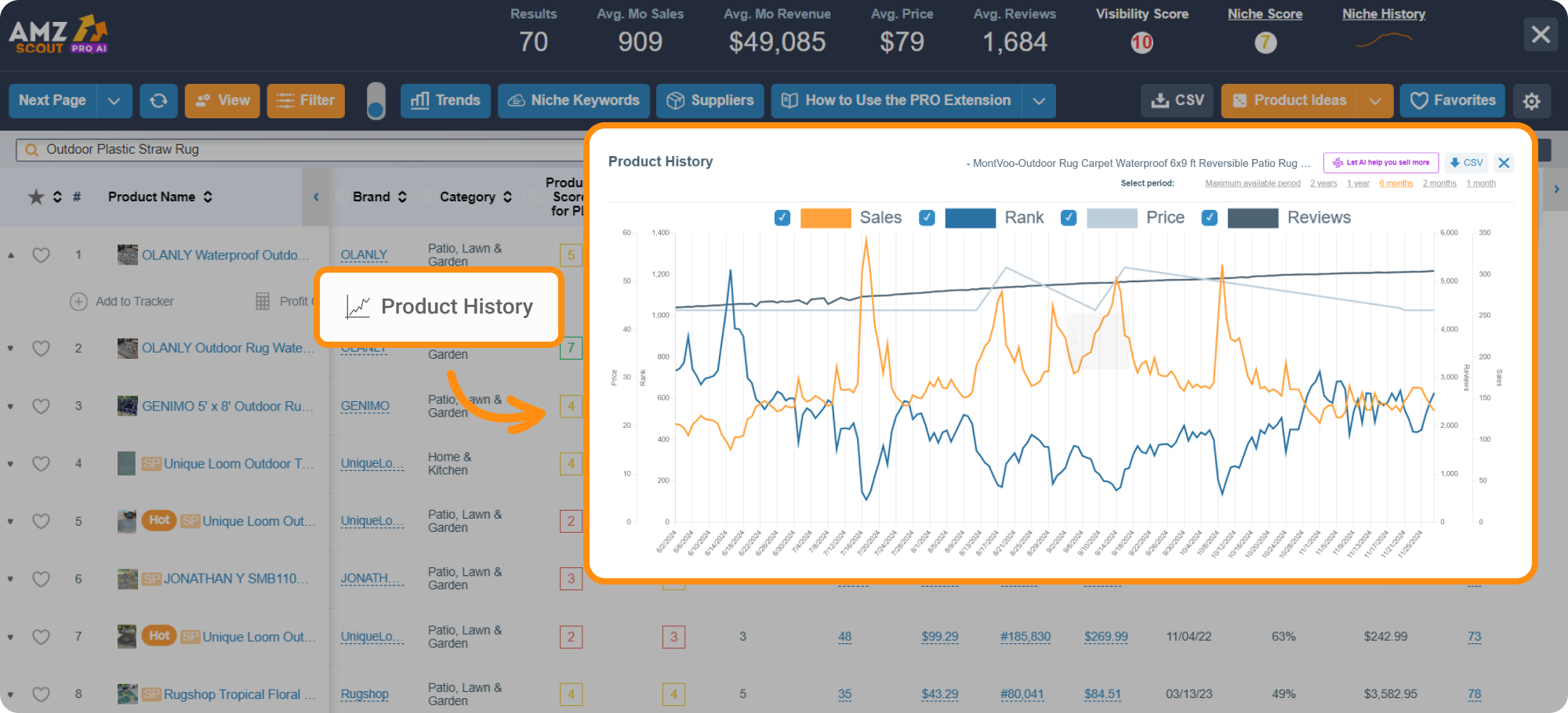

2. Check the product’s demand. To do this, you need to assess the Product History, which allows you to examine sales performance, reviews and pricing changes, and seasonality (if applicable). This helps you plan your inventory, allowing you to anticipate demand fluctuations and avoid stock issues during seasonal peaks.

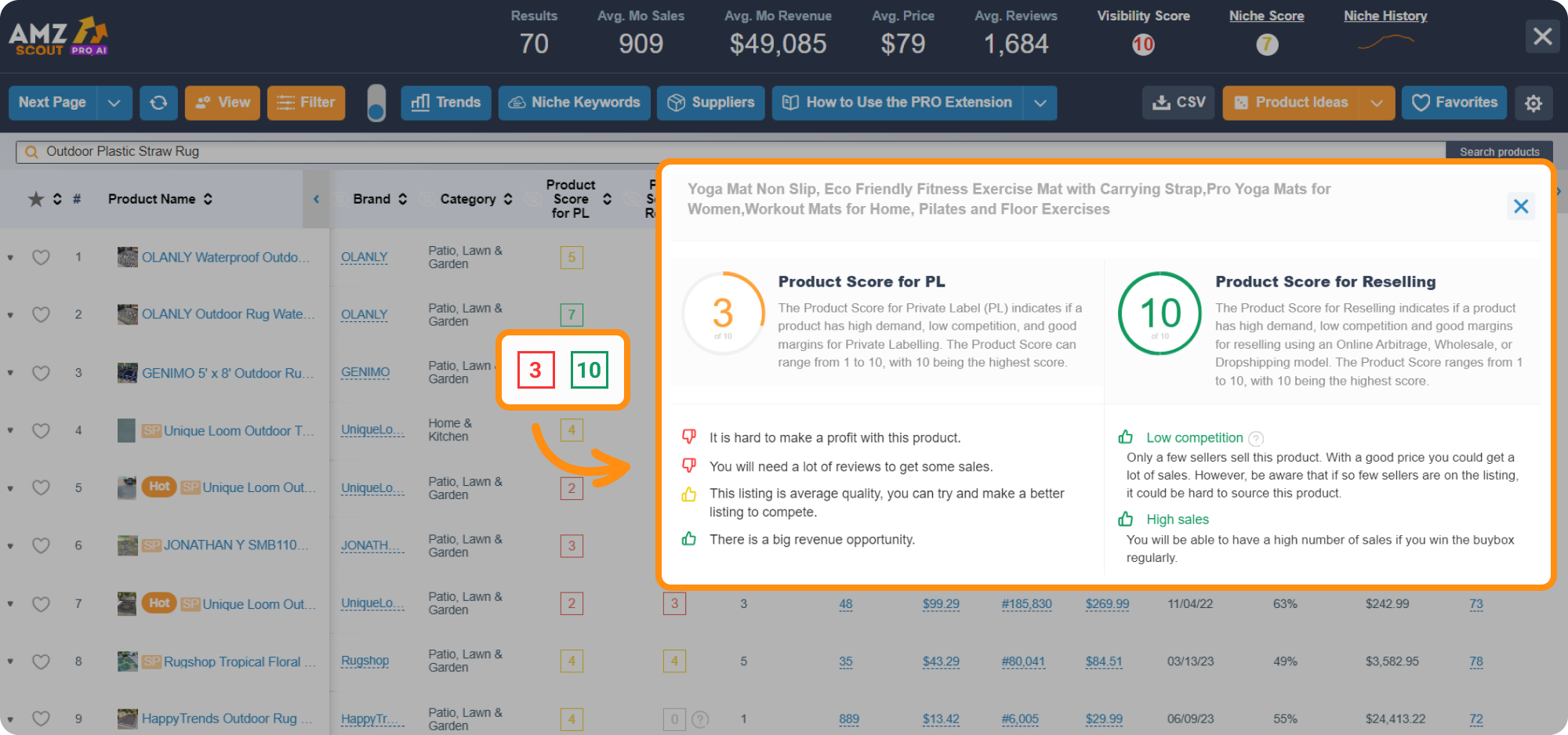

3. Access competition. Assess market competition by reviewing the tool’s dashboard. Here’s what you need to check:

For Private Label: See if there are any strong brands with a lot of reviews to gauge the competition in the niche. If those brands attract the majority of sales, it will be difficult to compete with them.

For Reselling: Look at the number of other sellers on a listing. Ideally, this should be between 5 and 15 to ensure balanced competition.

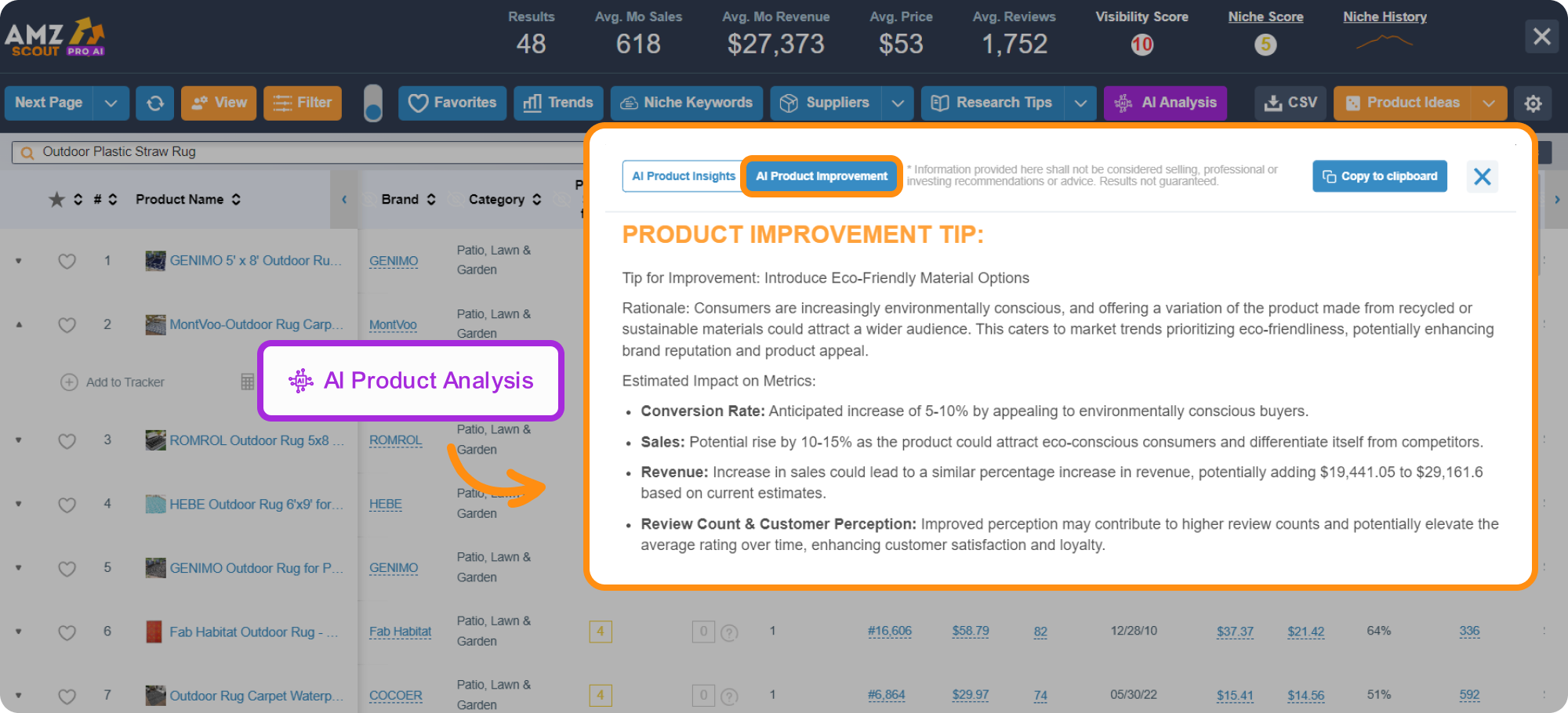

4. Evaluate risks and opportunities. Utilize the AI Product Analysis tool to conduct in-depth analysis of strengths and weaknesses. By reviewing data from various products within a niche, you can gain valuable insights into the niche's overall potential.

Identify market gaps: For private-label sellers, this analysis can reveal areas where competitors fall short, giving you the chance to create products that outperform them.

Boost profitability: Use the AI Product Improvement feature to receive tailored suggestions on how you can enhance the profitability of your product.

By using tools like the AMZScout PRO AI Extension, sellers can analyze demand, competition, and pricing to identify a “secure” product with high potential. This research increases your chances of success by helping you choose profitable items, avoid oversaturated markets, and develop a strong pricing strategy.

2. Monitor Inventory Levels

Maintaining optimal inventory levels prevents stockouts and overstocking, both of which can hurt your bottom line.

Stockouts can lead to missed sales opportunities, dissatisfied customers, and potential damage to your seller rating. On the other hand, overstocking ties up capital in unsold inventory, increases your storage costs, and risks product obsolescence or spoilage. Striking the right balance is essential to maximize profitability and maintain a smooth operation. Reviewing your inventory data regularly helps you stay ahead of fluctuations in demand.

3. Stay Compliant with Amazon Policies

Amazon’s policies are designed to protect buyers and ensure fair competition. Adhering to these rules prevents penalties, account suspension, or legal issues. Remain up to date with the latest requirements and guidelines for resellers, private label sellers, and other business models.

These proactive measures will help you minimize risk, maximize profitability, and ensure long-term success. With careful planning and consistent effort, your business will be well-equipped to face challenges and take advantage of new opportunities as they arise.

Conclusion

Insurance is more than just a safety net—it’s a strategic investment in the longevity of your Amazon business. Complement your insurance policy with proactive measures like thorough product research, inventory management, and policy compliance to create a robust protection strategy. By investing in comprehensive coverage and implementing best practices, you’ll set the stage for long-term success.