A Complete Guide to Amazon Seller Fees in 2025

It’s easy to just focus on potential profits when you’re starting an Amazon business. However, in order to be successful you need to consider Amazon seller fees as well. Being aware of these fees so you can save as much money as possible will be critical to maximizing your income.

There are a number of different fees Amazon sellers can be charged with and it can be hard to keep track of them sometimes. That’s why we’ve put together this comprehensive guide to make it easy for you to estimate what your costs will be.

Table of contents

Keep reading for a complete breakdown of all of the Amazon seller fees in 2025.

Note: The following fees are for American sellers. If you’re located in Canada, the UK, India, or anywhere else your fees will be different.

What is an Amazon Seller Fee?

While selling on Amazon is great it doesn't come for free. Amazon is providing you with a number of benefits by letting you sell on their marketplace, so naturally they're going to charge you for that service. Their fees come in different forms, including taking a cut of your sales and charging you for utilizing their FBA program.

In the end though, the cost to sell on Amazon is worth it and if you manage your business correctly there’s no reason why you still can’t be highly profitable. When you’re estimating your profits just make sure to deduct your fees for an accurate prediction.

So, with that said, let’s go over the various types of fees that you might be charged.

Types of Amazon Seller Fees

There are four main types of Amazon seller fees that you’ll have to deal with, as well as some additional fees that you may have to pay depending on your situation.

Amazon Seller Account Fee

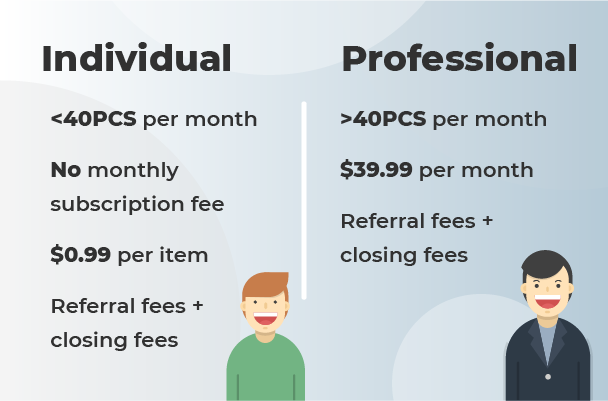

In order to sell on Amazon you’ll need to sign up for a seller central membership. You’ll have two different payment options, so you’ll have to choose the one that best suits your business:

Amazon Individual Seller Fees: With this plan there’s no monthly subscription. Instead, you’ll pay $0.99 every time you sell a product. In addition, you’ll also pay a referral fee that ranges from 6%- 45% and closing fees that range from $0.45 to $1.35.

Amazon Professional Seller Fees: This plan comes with a monthly subscription fee of $39.99. However, you don’t have to pay the $0.99 fee for every item you sell. Referral and closing fees still apply to Professional Seller accounts though.

If you do the math you’ll realize that if you sell less than 40 products a month it’s cheaper to go with the Individual Seller plan, whereas if you sell more than 40 products a month the Professional Seller plan becomes more cost-effective.

The Professional plan also comes with a number of additional benefits, including the ability to sell in multiple categories, use Amazon ads to promote your products, and offer free shipping promotions. So, keep that in mind when you make your decision.

Referral Fees

Every time you make a sale a certain percentage of the total sale price will be paid to Amazon. Consider this a type of finder’s fee since they’re essentially facilitating the transaction.

The amount varies depending on the category you’re selling in, with fees ranging from 6% - 45%. However, on average the fee falls between 8% and 15%.

Click here for a complete list of Amazon’s referral fees.

To maximize your profits it’s a good strategy to only sell in categories that have a referral fee of 15% or less. This includes categories like Camera & Photo, Kitchen, Office Products, Toys & Games, and Handmade.

FBA Fees

If you’re utilizing the Fulfilment by Amazon (FBA) program to sell your items there are some additional fees that you’ll have to consider.

With FBA, you’ll ship your inventory to Amazon and they’ll take care of everything from there. Your products will be kept at one of their locations and every time you make a sale they'll prepare the order and ship your items for you.

There are two types of FBA Fees:

Storage Fees

This is the fee Amazon charges you to store your items in their warehouse. It’s charged monthly based on the cubic feet of your items.

Here are some things to consider with it comes to storage fees:

Bigger items cost more to store in Amazon’s facilities, so try to stick to smaller products.

Anything that’s flammable, corrosive, and could potentially be harmful to people is considered “dangerous” by Amazon and will increase storage fees.

Storage fees go up in October, November, and December, so avoid having your items sit in storage long-term during these months, as it can be costly.

There are a number of factors that go into FBA storage fees. You can see a full explanation of the pricing structure here.

Fulfilment Fees

This portion of your FBA fees covers the cost to pick your orders from storage, prepare them for shipment, and mail them to your customers. The heavier your products are the more Amazon will charge you for this service. There’s also an additional charge attached to clothing items and dangerous goods.

Click here to see a full rundown of how fulfilment fees work.

Shipping Fees

One last type of Amazon seller fee you’ll have to consider is shipping. While this fee isn’t charged by Amazon themselves, it’s still something you’ll have to pay whether you’re fulfilling your own orders using FBA.

For Fulfilled by Merchant Sellers

Amazon will pay you a shipping credit for every order to cover your costs. Unfortunately, the amount they pay you is often less than the actual cost to ship your products. As a result, shipping costs can eat into your profits if you’re not careful.

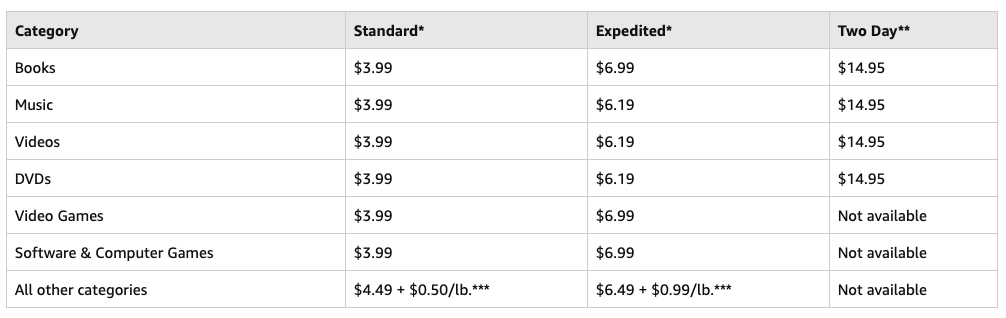

Here are the shipping credits you’ll receive for domestic orders:

By subtracting your credit from your shipping costs you’ll be able to determine how much you’ll actually be paying for shipping. So, make sure to keep that cost in mind when pricing your products. Also, remember that if you’re offering free shipping you won’t receive a credit from Amazon and will have to cover all the shipping costs yourself.

For FBA Sellers

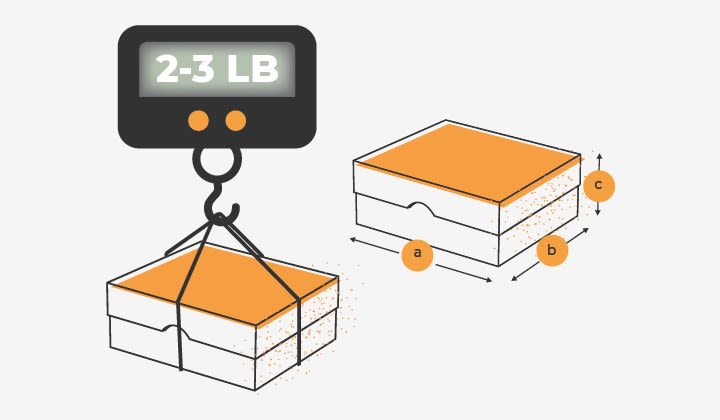

While the cost of shipping items to your customers is built into your FBA fees, you still have to pay to ship your products to Amazon’s warehouse. The cost will depend mostly on the size and weight of the package you ship to them, which is another reason to stick to selling small lightweight items.

Additional Fees

In addition to the fees listed above, you should also be aware of the following fees:

Variable Closing Fee: Amazon adds a $1.80 fee for any sale made under one of its media categories. This includes books, DVDs, music, software, and video games.

Processing Fee: You’ll be charged $0.10 per unit every time you ship Amazon your products (this only applies to FBA sellers).

Removal Orders: You may decide to remove your products from FBA storage. To have your items returned to you it costs $0.50 per piece for standard-sized items and $1.25 per piece for oversized items. For disposal, it costs $0.15 per piece for standard-sized items and $0.50 per piece for over-sized items.

Taxes: These are paid to the government, not Amazon, but it’s still something to consider. You won’t have to pay any type of VAT assuming you import your products from China, but you will likely have to pay some sort of duty. And then you’ll also have to pay income tax, so make sure to set aside a portion of your profits throughout the year so you have it ready when tax season rolls around.

How to Calculate Your Amazon Seller Fees

When you’re analyzing products and deciding what to sell it’s important to be able to estimate your Amazon seller fees, as these directly impact your profits. If your fees and the cost to purchase an item from a supplier are too high you’re not going to be able to make any money on that product.

If you want to know what your fees will be you can use AMZScout’s tools to get an accurate estimate.

How to Use AMZScout’s Tools

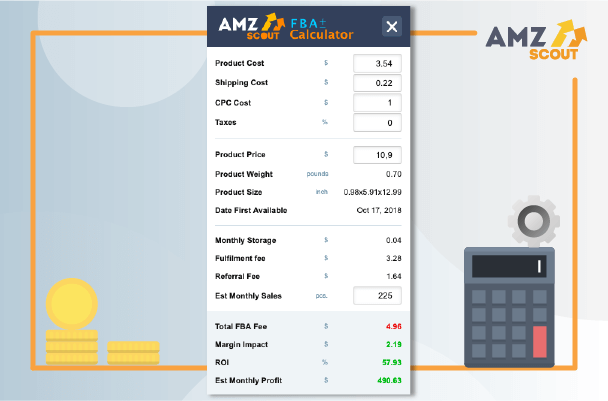

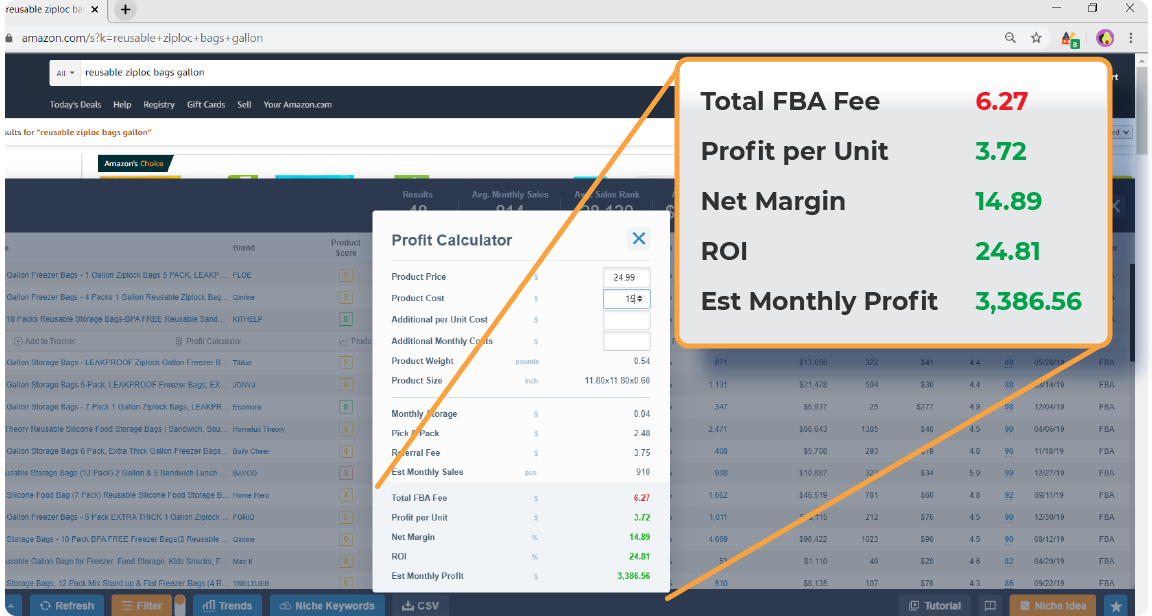

The AMZScout Calculator is a free Google Chrome extension that will allow you to quickly estimate potential fees.

Click here to install the Calculator, then find the product you’re interested in on Amazon.com. Once you’re on the product’s listing page just click the Calculator icon in your browser to instantly get a fee estimate. You can also enter other costs, such as the price per unit and shipping expenses for a complete picture of the fees.

If you want a more complete solution, you can also try the AMZScout Pro Extension. In addition to offering a profit calculator, it will also allow you to check other data, such as monthly sales, average price, reviews, historical trend reports, product and niche scores, and more.

You can also opt for the AMZScout Toolset, which includes the Pro Extension, Web App, Keyword Tools, exclusive Amazon insights, and more.

How are the Fees Calculated?

The Calculator and Pro Extension use the weight and size to calculate the FBA fees, based on Amazon’s FBA fee table. They also use the category the product is sold in, and the sales price, to preview the referral fee automatically.

Can You Calculate the Fees on Your Own in Excel?

Theoretically yes, you could use excel or even a calculator to estimate the fees yourself. But this involves searching through Amazon’s various fee tables to find the rates that apply to your product. You’d also need to look up the size, weight, category, and price of your product to ensure you take the right fee from the tables. This is all very time-consuming.

That’s why we created the AMZScout Calculator. It accurately estimates your fees in seconds, saving you valuable time and making it easier for you to find profitable products.

Frequently Asked Questions

While we’ve explained Amazon seller fees pretty thoroughly here, it’s understandable if you still have questions. Here are some of the most common questions we receive about this topic to provide you with a little more guidance:

How Can I Lower My Amazon Seller Fees?

This is a great question, as you want to do everything you can to keep your fees as low as possible. Here are three things you can do to reduce your fees:

Sell Products that are Small and Light: This is a great way to keep costs down. Small and light items lead to less FBA fees. They are also generally cheaper to purchase from suppliers and result in fewer shipping fees.

Pick the Right Category: Referral fees vary based on category, so try to sell in a category that has lower fees. You may also want to avoid media categories so you won’t be charged the variable closing fee.

Avoid Dangerous Goods: Dangerous goods carry additional fees. Plus, they can result in legal issues if they’re not packaged correctly so it’s best to just stay away from these products.

How Do Amazon Seller Fees Compare to eBay Fees?

If you’re selling on a 3rd party platform you can’t avoid fees, and that goes for eBay as well. Here’s how their fees work:

Insertion Fee: You can create 50 listings per month for free. Any more than that and you will have to pay a fee ranging from $0.35 - $100, depending on the product you’re selling.

Final Value Fee: This is the eBay equivalent of the referral fee. It ranges from 2% - 12%.

Overall, eBay’s fees are a little less, but Amazon has far more traffic. With so many regular users and Prime members it’s definitely worth it to sell on Amazon.

Can You Get Your Amazon Seller Fees Back?

There are two instances where you can get part or all of your Amazon Seller Fees back:

If you open a Professional Seller account by mistake and want to switch to an Individual account you can contact their support team to get a refund.

If you issue a refund for one of your products you will get part of your fees back. Amazon will keep 20% of the fees they collected, up to a maximum of $5. However, you can charge customers a restocking fee if they return an item to make up for this. Check out Amazon’s return policy to learn more.

In any other situation your fees are non-refundable.

Conclusion

Understanding the fees you’ll have to pay when selling a new product is critical to building a successful Amazon business. So, make sure to do your homework before deciding to sell a certain product. And if you need any help calculating fees AMZScout’s Calculator and Pro Extension can assist you.