How Amazon Tariffs 2025 Will Affect Sellers and Prices

The U.S. e-commerce landscape is shifting in 2025, with new tariff laws reshaping costs for Amazon sellers. The de minimis exemption, which previously allowed shipments under $800 to enter duty-free, was suspended in August 2025, meaning even low-value imports now face duties and fees. On top of this, broader tariffs and stricter enforcement are raising prices and complicating cross-border trade. For sellers sourcing from China and other markets, understanding these changes is essential to stay profitable and competitive.

Table of contents

What Are Amazon Tariffs and Why Do They Matter?

In the context of Amazon selling, tariffs are essentially import duties or taxes levied on goods shipped into the U.S. from international suppliers. For sellers, these are not abstract numbers. They translate directly into higher costs for sourcing products. When Amazon imposes or reflects these duties through Amazon tariffs display, the additional charges are often passed on to the buyer, subtly raising prices across the platform.

These fees affect more than just numbers on a spreadsheet. They shape a product’s final price, its competitiveness, and a seller’s profit margins. Electronics, textiles, and other high-duty items serve as prime examples: a $100 gadget with a 15% tariff can suddenly carry $15 in extra costs, eating into profit or forcing sellers to adjust pricing strategies. The ripple effect is clear - tariffs influence what products remain viable, which items get prioritized for stock, and ultimately, how Amazon and China tariffs can dictate the economics of online retail.

Understanding these mechanisms is essential for any seller navigating the evolving marketplace. Ignoring tariffs can leave margins vulnerable, while proactive management allows sellers to anticipate costs and show tariffs transparently, maintaining trust with customers while staying competitive. Sellers sourcing from China, in particular, must pay attention to Amazon China tariffs, as these can significantly impact product cost and competitiveness.

What Are the Key Tariff Changes in 2024–2025?

Over the past year, U.S. trade policy has introduced several shifts that affect Amazon sellers in tangible ways. One of the most significant updates is the overhaul of the de minimis rule, which previously allowed shipments under $800 to enter the country duty-free. As of August 2025, this threshold has been eliminated for most imports, meaning that even small orders are now subject to duties and fees. For sellers, this change alone can alter the economics of selling, as smaller shipments that once flew under the radar now carry unexpected costs.

In addition to the de minimis shift, several broader tariff updates have reshaped cross-border selling:

Universal 10% tariff on all imports: A baseline tariff applied to most imported goods, raising costs for sellers across categories.

Country-specific "reciprocal" tariffs: Additional tariffs targeting countries deemed to have unfair trade practices, affecting sourcing strategies.

Targeted tariffs on specific industries: Certain product categories, such as electronics, apparel, and accessories, face extra duties, affecting prices and profit margins.

For example, a $50 pair of headphones shipped from China that previously avoided duties now faces a tariff, raising prices for consumers and reducing the margin for sellers. These changes highlight the growing importance of understanding how tariffs will affect Amazon, especially for those who rely on international suppliers to remain competitive.

Staying ahead requires sellers to monitor these shifts closely, anticipate cost increases, and consider strategic adjustments to pricing, sourcing, and inventory planning.

How Do New Tariffs Affect Amazon Sellers?

The new wave of tariffs is more than just an administrative change and it has real consequences for Amazon sellers. For many, the immediate effect is rising costs. Import duties and fees directly reduce profit margins, particularly for products with tight pricing. Electronics, apparel, and accessories that once offered healthy returns are now far more sensitive to tariffs, forcing sellers to rethink pricing strategies or absorb lower profits.

Higher costs also often translate into higher retail prices, which can weaken conversion rates. Shoppers are increasingly price-conscious, and even modest increases may deter purchases. A $25 accessory that jumps to $28 due to tariffs can see a noticeable drop in sales velocity, highlighting the delicate balance between staying profitable and remaining competitive. Understanding how Amazon showing tariffs affects customer pricing is critical for sellers managing profit margins under the new rules.

Recent marketplace data supports this. SmartRepricer found that sellers who raised prices by more than 20% during tariff adjustments saw conversion rates fall by over 50% and sales velocity drop nearly 60%. In contrast, those who limited price hikes to under 3% performed far better, showing how sensitive Amazon buyers are to even small pricing changes.

The impact is not uniform across the marketplace. Large brands with established margins and diversified supply chains may weather the changes, while small and mid-sized sellers often feel the strain most acutely. For smaller sellers, every shipment carries a risk: will Amazon be affected by tariffs in a way that forces them to raise prices or sacrifice margin? Understanding this dynamic is crucial for navigating the evolving landscape.

In short, Amazon tariffs don’t just alter costs. They influence strategy, pricing, and the very viability of certain product lines. Sellers who anticipate these shifts and adjust proactively will be better positioned to thrive despite the added pressures.

How Can Sellers Adapt to New Tariff Rules?

Navigating Amazon tariffs doesn’t have to mean shrinking margins or lost opportunities. Sellers who take a strategic approach can turn these challenges into actionable decisions. One of the first steps is to reevaluate suppliers. Consider local sourcing or nearshoring to reduce exposure to high tariffs and shipping costs. Products manufactured closer to your target market can lower duties, shorten delivery times, and give you more control over inventory.

Optimizing logistics is another critical lever. Consolidating shipments, choosing warehouse locations strategically, and balancing order size against duty costs can make a significant difference. By improving efficiency, sellers can offset some of the charging pressures from new tariffs and maintain competitive pricing.

Sellers may also benefit from focusing on lower-risk product categories, particularly items less affected by duties or already carrying sufficient margin buffers. Electronics, textiles, and luxury goods tend to absorb tariffs less gracefully, while certain household items or essentials may remain more resilient.

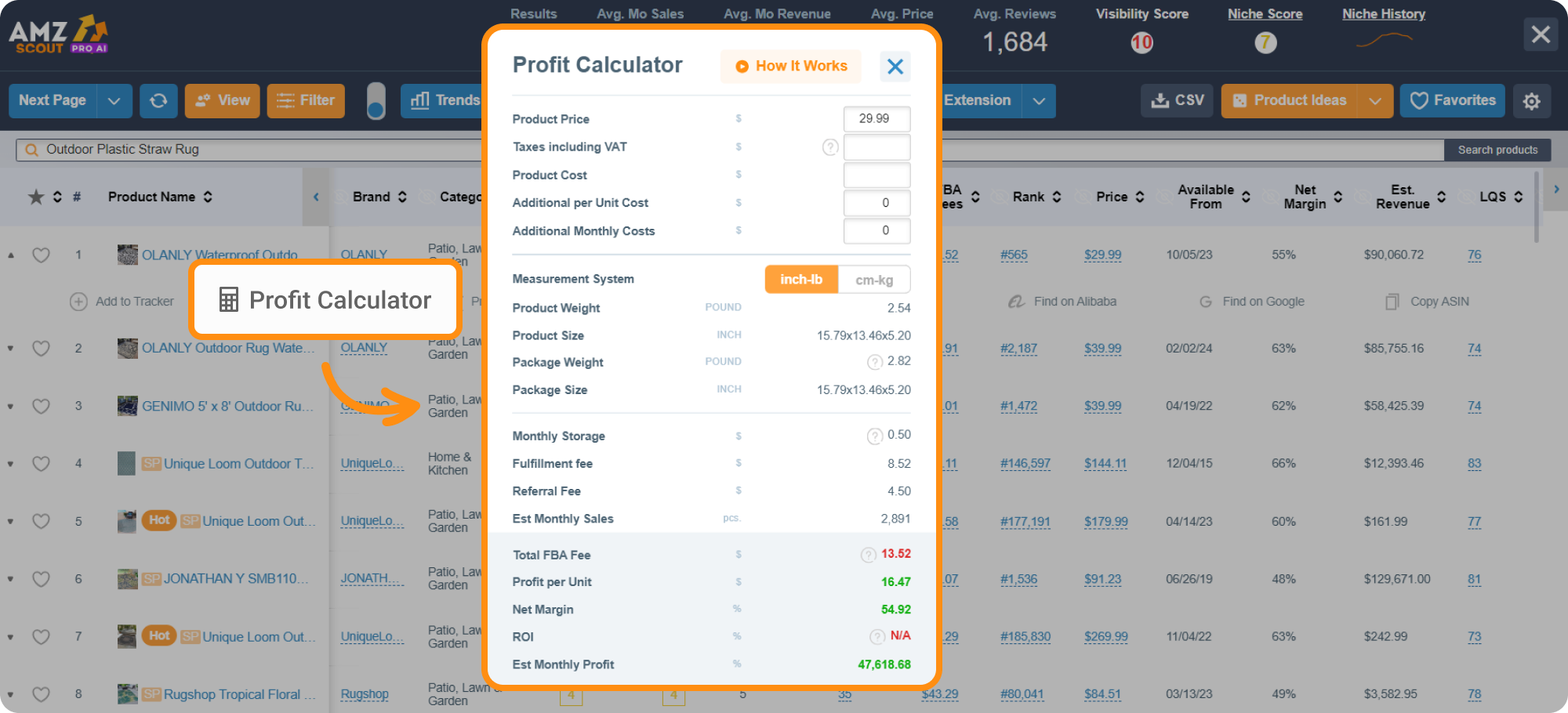

Financial tools can provide clarity in this complex environment. The AMZScout PRO AI Extension includes a Profit Calculator to model margins with new tariffs:

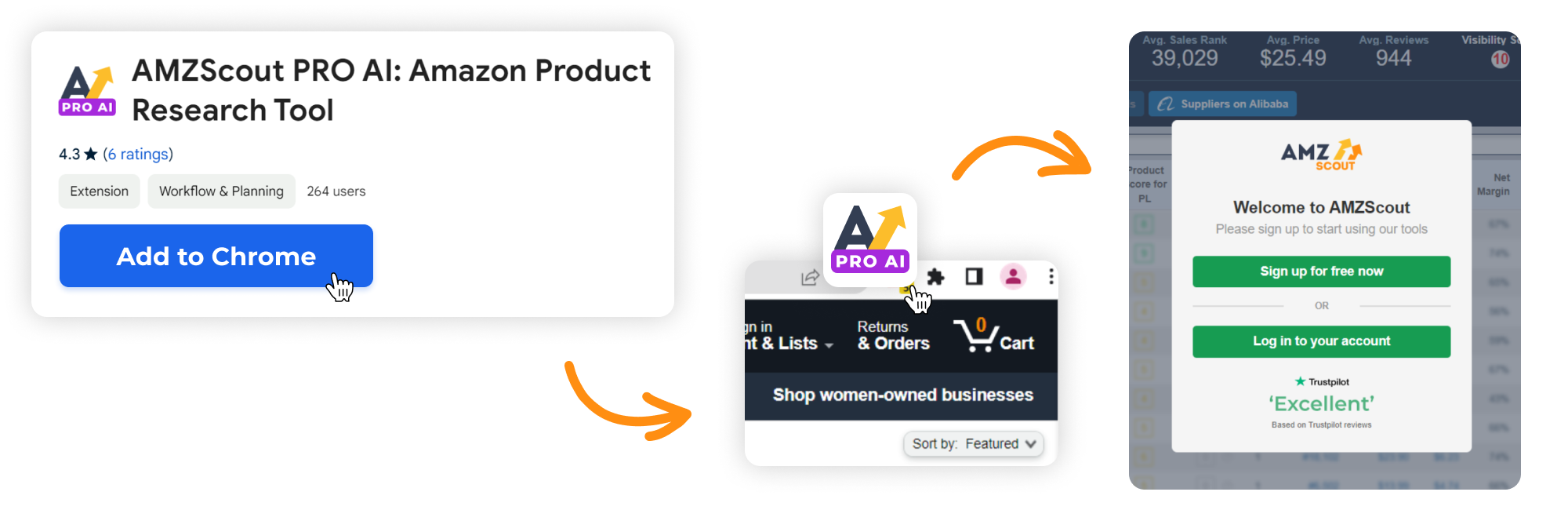

Step 1. Install the AMZScout PRO AI Extension for Chrome.

Step 2. Search for a product directly on Amazon by entering its name.

Step 3. On the product page, click the AMZScout PRO AI Extension icon in your browser. This will open the AMZScout dashboard directly on the page.

Step 4. Locate and click the “Profit Calculator” option below the product listing. Enter all relevant cost details such as product cost, shipping fees, Amazon FBA fees, and any other expenses related to selling the item.

Step 5. The tool will automatically estimate your profit per unit and display your expected profit margin. This allows you to quickly assess whether the product is financially viable before committing to sourcing.

Pro Tip: A profit margin above 20% is generally considered strong and supports long-term, sustainable business growth on Amazon.

For example, a $10 product with a 7% tariff reduces profit by $0.70. This insight allows sellers to adjust pricing, sourcing, or even inventory strategy before committing, ensuring they remain competitive without sacrificing profitability. By combining supplier strategy, logistics optimization, and smart financial tools, sellers can adapt effectively to the shifting tariff landscape.

What Should Sellers Do Next?

Navigating Amazon tariffs requires deliberate action. Sellers who treat tariffs as an afterthought risk eroding profits and competitiveness. Here’s a clear and actionable roadmap:

Recalculate Margins for Every Product

The end of the de minimis exemption makes every shipment subject to duties and fees. Even low-value items now carry costs that directly affect profit. Reassessing margins ensures you know which products remain viable and which may need a pricing adjustment to maintain profitability.

Adapt Pricing and Sourcing Strategy

Rising costs mean pricing cannot remain static. Consider revising your pricing structure to absorb tariffs without losing sales, or explore alternative suppliers (local or nearshored) to reduce exposure. Strategic sourcing can lower tariffs, shorten delivery times, and give you more control over inventory.

Leverage Financial and Analytical Tools

Tools like the AMZScout PRO AI Extension allow sellers to model profit under new tariff conditions. By using the Profit Calculator, sellers can simulate the impact of duties on each product and make informed decisions about pricing, sourcing, and inventory.

Monitor Tariff Changes Continuously

Tariff laws are evolving, and policies like Amazon Trump tariffs, country-specific reciprocal tariffs, and targeted industry tariffs can change quickly. Keeping a close watch ensures that your strategy remains flexible and minimizes surprises.

Integrate Tariff Awareness Into Daily Operations

From sourcing to pricing to marketing, tariffs should now be a core part of your business strategy. Transparency with customers, smart inventory planning, and proactive adjustments help maintain competitiveness while protecting margins.

By following these steps, Amazon sellers can turn a challenging landscape into a manageable one and stay profitable, competitive, and prepared for whatever new tariff laws emerge next.

Final Thoughts

Tariffs are no longer a peripheral concern. They are a defining factor in Amazon selling in 2025 and beyond. From the end of the de minimis exemption to universal and industry-specific duties, these changes directly influence costs, pricing, and profitability. Sellers who ignore the shifting landscape risk eroded margins and lost competitiveness, while those who adapt strategically can turn challenges into opportunities.

Leveraging insights, recalculating profits, and using tools like AMZScout to model the impact of tariffs allows sellers to make informed decisions, optimize strategies, and stay ahead of the curve.

FAQ

Do Amazon sellers have to pay tariffs directly?

No. Tariffs are usually included in the product’s cost from overseas suppliers, so sellers don’t pay them directly to the government. Instead, these fees are factored into pricing and sourcing decisions.

Can tariffs make some products unprofitable to sell on Amazon?

Yes. Products in high-duty categories, such as electronics or apparel, can become unprofitable if tariffs significantly increase costs. Sellers should regularly review margins and consider adjusting pricing or switching products.

How can sellers reduce the impact of tariffs?

Sellers can mitigate tariff costs by sourcing locally or nearshoring, consolidating shipments, focusing on lower-duty product categories, and using profit-analysis tools to plan pricing and sourcing strategies effectively.