Do I Need an LLC to Sell on Amazon?

Once you decide to start your own Amazon business, setting up an Amazon seller account is the easy part – now you're ready to jump into the world of online retail. But when it comes to choosing the right business structure, things can become confusing quickly. You may find yourself asking:

"Do I need an LLC to sell on Amazon?"

Well, the answer is not as straightforward as you might think.

In this article, we'll guide you through the factors that can influence whether an LLC (Limited Liability Corporation) is necessary for your Amazon selling journey, and how to go about setting one up if you decide it's the right move.

What is an LLC?

An LLC is a popular type of business structure that offers protection to business owners and also provides tax advantages. As an Amazon seller, you have the option to operate as a sole proprietorship, but this doesn't protect your personal assets if any legal issues arise.

Do you need an LLC?

No, you do not need an LLC to sell on Amazon as an individual. If you are just starting out, or if this is not your main source of income, then you can start selling on Amazon without a business license.

However, there are some cases where forming an LLC can be beneficial for your Amazon business. When you have an LLC, it helps to safeguard your personal assets from legal liabilities related to your Amazon business. This means that if your business faces any lawsuits or claims, your personal possessions (like your home or car) are protected.

Having an LLC also creates opportunities for growth and expansion. It allows you to access important resources like bank accounts, business licenses, and other necessary requirements that can help you manage your Amazon business more efficiently. It's important to note that if you join Amazon's FBA (Fulfillment by Amazon) program, having an LLC is vital in order to align with Amazon's compliance rules.

Understanding Amazon Seller Requirements

When it comes to selling on Amazon, there are specific requirements to be aware of. Let's address some common questions regarding who can sell on Amazon and whether there are any restrictions based on citizenship or other factors.

Open to Anyone

In general, Amazon allows both individuals and businesses to sell online through their platform. This means that, in most cases, anyone can create a seller account and start selling products on Amazon. You don't necessarily need to be a big company or have prior business experience to get started.

No Citizenship Requirement

Amazon does not impose a specific citizenship requirement for sellers in the United States. You don't have to be a U.S. citizen to sell on the Amazon marketplace within the country. Individuals who are not U.S. citizens can still register as sellers and conduct business on this platform. However, you will need to provide valid identification and tax information to comply with U.S. tax laws.

Identification and Tax Information

In order to open a seller account on Amazon, you will be asked to provide certain forms of identification and tax-related information. This typically includes your name, address, contact details, and a valid form of identification, such as a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). These requirements ensure that sellers can be properly identified and comply with tax regulations.

Additional Requirements

While Amazon generally welcomes both individuals and businesses as sellers, there may be additional requirements depending on the type of products you plan to sell. Certain categories, such as restricted products (e.g., weapons, prescription drugs) or branded products, may have specific guidelines or require additional permission from Amazon.

International Selling

If you are located outside the United States and wish to sell on Amazon's U.S. marketplace, you can participate in the Amazon Global Selling program. This program allows sellers from various countries to reach customers in the U.S. and other international markets. However, in this case, there may be additional considerations and requirements, such as tax obligations and customs regulations, that you need to be aware of when selling internationally.

Does Amazon Require an LLC to Sell Certain Products or Brands?

Sometimes, certain brands or products on Amazon may have requirements that sellers need to meet. While Amazon itself doesn't specifically mandate having an LLC for selling products, there are situations where having an LLC can be beneficial or even required for certain brands or products.

One example is the Amazon Brand Registry program. If you want to sell branded products and enroll in this program, having a registered trademark is often necessary. Forming an LLC can make it easier to obtain a registered trademark, which may be required for brand registry.

As stated earlier, some brands or manufacturers may have their own requirements for sellers. They might prefer or require sellers to have an LLC or a registered business entity to maintain a professional image or to ensure compliance with their distribution policies.

Note that these requirements are specific to certain brands or products and are not imposed by Amazon itself. Each brand or product may have its own set of guidelines or restrictions, and it's crucial for sellers to familiarize themselves with any such requirements when dealing with particular brands or products.

How Do I Check Amazon Product Data?

If you are a beginner seller looking for products to sell, it’s recommended to utilize specialized product research tools. For instance, AMZscout helps sellers identify whether a product is private-label or being sold by multiple sellers under a brand. It also lets you know if your product category is gated or ungated on Amazon. These tools can also provide valuable insights into a product's metrics, such as sales history, pricing trends, and profitability.

Here’s how it works:

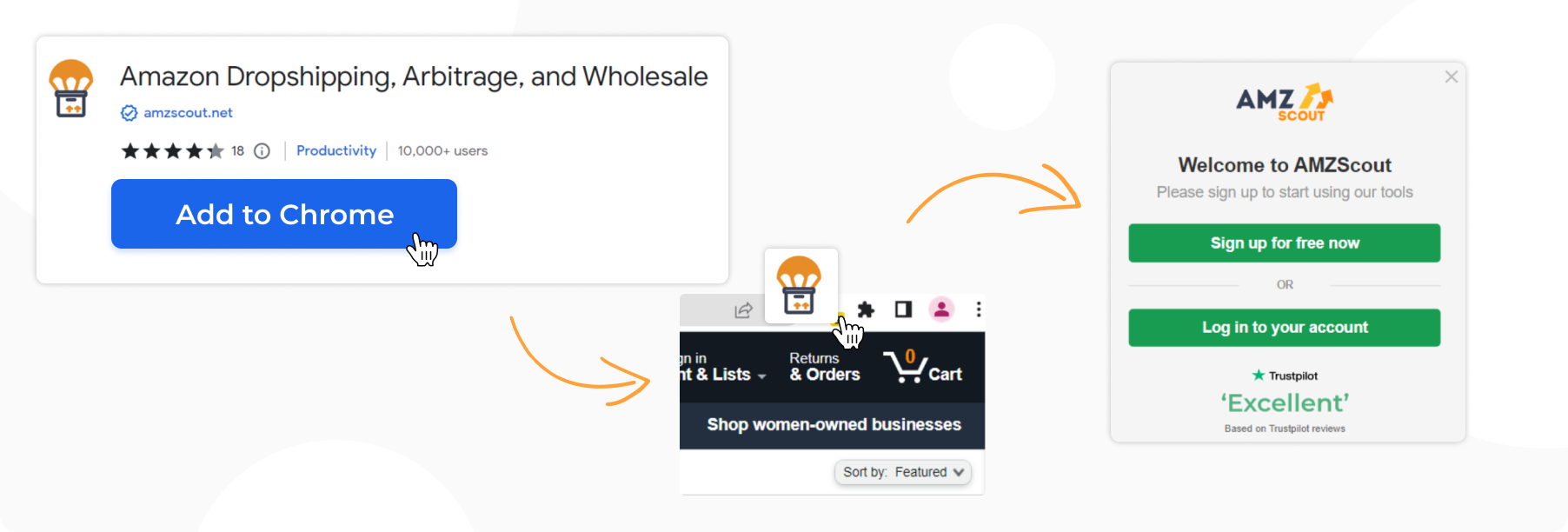

1. Install the Amazon Dropshipping, Arbitrage, and Wholesale Extension.

2. Start your free trial. You will need to create an account, but you don’t need to provide any credit card information.

3. Browse Amazon to search for products you’re interested in. Open Amazon and search for a niche.

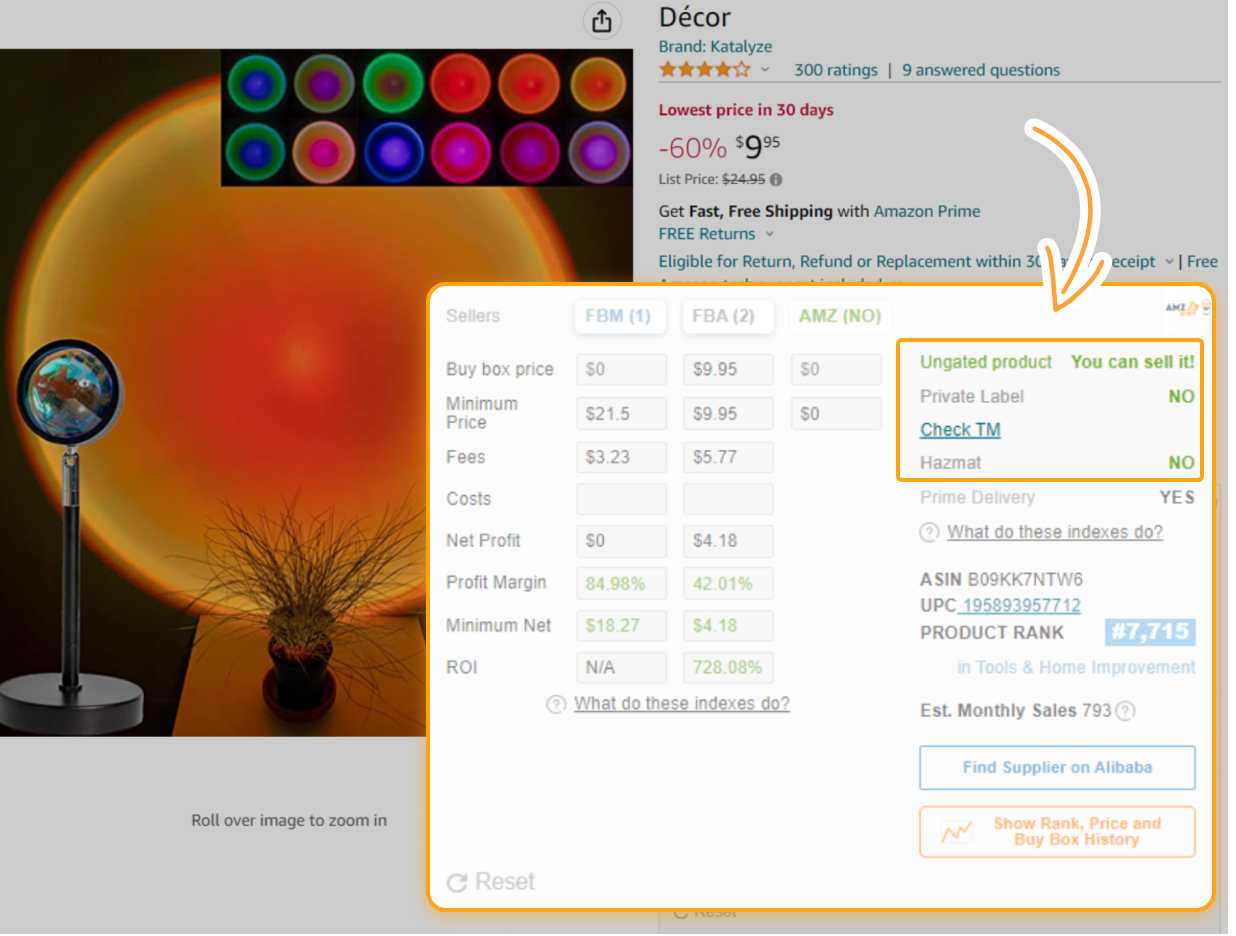

4. Analyze product data. To evaluate each product, go to its page. You’ll see the app as an in-built window with important information about the product. Review important criteria that may make it difficult or impossible to resell:

If the product is a Private Label: This means it is sold by only one merchant who has a brand registry. Sourcing this product is likely impossible for Dropshipping or Online Arbitrage because someone else owns it.

If the product is in a gated category or it contains hazardous materials (hazmat): Reselling these products will be difficult as they require additional certificates or extra approval from Amazon.

5. Check other factors. After reviewing the criteria in the app, you also can check out more information about the product. Data like Price History and Buy Box History display price fluctuations, and the built-in calculator allows you to estimate potential profit margins.

Using these tools can help you make informed decisions when conducting product research and competitive analysis on platforms like Amazon.

The Benefits of Selling on Amazon as an LLC

Forming an LLC offers both legal and tax benefits that you may not receive with a sole proprietorship. Some of the main benefits of an LLC are:

Personal Asset Protection. One significant advantage of operating as an LLC on Amazon is the protection it provides for your personal assets. As an LLC, your personal possessions (like your house or car) are generally safeguarded in case your business encounters legal issues or financial challenges. This limited liability protection can bring you peace of mind as you navigate the world of e-commerce.

Credibility and Professional Image. Having an LLC lends added credibility to your Amazon business. It gives potential customers the impression that you're a serious and professional seller. Many buyers feel more confident purchasing from a registered business entity, such as an LLC, as it conveys a sense of trust and reliability.

Tax Benefits and Deductions. Operating as an LLC allows for flexibility in how your Amazon business is taxed. LLCs have the advantage of "pass-through" taxation, which means the profits and losses of the business pass through to the owners' personal tax returns. This can potentially result in lower overall tax liability. LLCs can often take advantage of various deductions and write-offs related to business expenses.

Setting Up an LLC

Now that you have a better understanding of the benefits of forming an LLC and when to consider if that option is right for you as an Amazon seller, let's explore the steps involved. If you decide to set up an LLC for your business, follow these steps:

Step 1: Research and Choose a Name

Start by researching and selecting a unique name for your LLC. Ensure that the name you choose is not already in use by another business. You can check the availability of the name through your state's business registry.

Step 2: File Articles of Organization

Prepare and file the required paperwork, known as "Articles of Organization," with your state's Secretary of State or relevant business filing agency. This document establishes your LLC as a legal entity and typically requires information such as the LLC's name, address, and the names of its members or owners.

Step 3: Create an Operating Agreement

While not always mandatory, it is highly recommended to create an operating agreement for your LLC. This agreement outlines the internal operations, rights, and responsibilities of the LLC's members. It helps to clarify the ownership structure, profit distribution, decision-making processes, and other important aspects of your business.

Step 4: Obtain an Employer Identification Number (EIN)

Apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique identification number assigned to your LLC for tax purposes. This number is necessary for opening a business bank account, filing taxes, and fulfilling other legal obligations.

Step 5: Register for State Sales Tax Permits and Licenses

Determine if you need to obtain any state sales tax permits or licenses for selling products on Amazon. Check with your state's revenue or taxation department to find out their specific requirements and procedures. Complying with state tax regulations is crucial in order to avoid any potential legal issues.

Step 6: Establish a Business Bank Account

Open a separate business bank account for your LLC. This account will help you keep your personal and business finances separate, making it easier to track income and expenses related to your Amazon business. It is essential for financial management and simplifies tax reporting.

Step 7: Maintain Compliance and Seek Professional Advice

Stay up-to-date on all legal and regulatory requirements relevant to your LLC. This includes filing annual reports, renewing licenses, and meeting tax obligations. It’s advisable to consult with a business formation company or an attorney who can provide guidance and ensure compliance with state and federal regulations.

Simplifying the Process with Special Services

Although it's not always required, setting up an LLC as an Amazon seller can provide numerous benefits, including liability protection, tax advantages, and establishing a professional image for your business. doola can assist you in simplifying this process, ensuring accurate financial records, and managing your bookkeeping needs. With an established LLC and proper guidance, you can confidently navigate the Amazon marketplace and achieve your e-commerce goals.

To assist you further in navigating the world of Amazon selling, tools like AMZScout are valuable resources. AMZScout provides helpful insights and data that can help you identify profitable products, analyze market trends, and make informed decisions about what to sell on Amazon.

FAQs

What is an LLC and why do I need it for the Amazon marketplace?

An LLC, or Limited Liability Company, is a legal entity that provides a level of liability protection for its owners. Amazon requires that some sellers have an LLC to protect themselves and their businesses on the marketplace.

How do I form an LLC for my Amazon business?

You can form an LLC by following the guidelines set forth by the state in which you plan to operate. Generally, you will need to file articles of organization, choose a registered agent, and pay a filing fee.

What are the ongoing requirements for maintaining an LLC on Amazon?

You will need to file annual reports and pay an annual fee to maintain your LLC. You may also need to renew your business license, file taxes, and keep accurate records of your transactions.

Can I operate my Amazon business as a sole proprietorship or partnership instead of an LLC?

While it is possible to operate on Amazon as a sole proprietorship or partnership, having an LLC provides a level of liability protection that these other business structures do not offer.

Are there any downsides to forming an LLC for my Amazon business?

One potential downside is that forming and maintaining an LLC can be more expensive and requires more paperwork than other business types. However, the protection an LLC provides can far outweigh these costs for many business owners. Consult with a legal professional or business advisor to determine which structure is best for your specific needs.

Can I sell on Amazon without an LLC?

Yes, you can sell on Amazon without having an LLC. Amazon allows individuals to sell products on its platform without requiring them to have a registered business entity. However, it's important to note that selling as an individual may have certain limitations and implications for taxation and liability purposes.